News

FINTECH: INUWA CALLS FOR COLLABORATION TO DEEPEN FINANCIAL LITERACY

AJAGBE ADEYEMI TESLIM

SPONSORED BY: H&H

In line with the present administration’s focus on Reforming the Economy for Sustained Inclusive Economic Growth, Accelerating Diversification through Industrialisation and Digitisation, and Improving Governance for Effective Service Delivery, the Director General of the National Information Technology Development Agency (NITDA), Kashifu Inuwa CCIE, has called for increased collaboration among key players in the Fintech ecosystem to enhance financial literacy and promote financial inclusion for all citizens.

The DG made this statement at the 6th edition of the annual FirstBank FinTech Summit where he joined other key players in the ecosystem in a session titled: “Policy and Infrastructure: Navigating Financial Regulations for Fintech Innovations” held at the Lagos Continental Hotel, Victoria Island, Lagos State.

Inuwa emphasised that NITDA’s regulatory approach, based on a triple helix model, is not just about imposing standards but actively creating and supporting markets.

Outlining the objectives of the Regulatory Intelligence Framework developed by the agency to creating marketing values, enabling innovations, protecting consumers and effectively discharging services, Inuwa noted that priority was given to collaborations with the ecosystem in meeting these deliverables.

“To achieve this, we came up with a way which we call the participatory framework or policy dialogue for any regulation. This is because at the heart of everything we do is co-designing and co-creation,” he said.

Speaking on working with the ecosystem, he noted that collaboration was instrumental in successfully implementing Nigeria’s cashless policy which the agency did in partnership with the Central Bank of Nigeria (CBN).

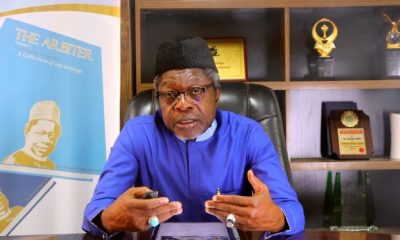

L-R: Olusegun Zaccheaus, Partner, West Africa Lead & Strategy; Kashifu Inuwa, CCIE, The Director General, NITDA; Bashir Are, CEO, Lagos State Lotteries & Gaming Authority; Adewale Salami, CTO, First Bank; Premier Owioh, MD & CEO, NIBBS in group photograph after a Regulatory Roundtable discussion on Policy and Infrastructure: Navigating Financial Regulations For FinTech Innovations at the FirstBank FinTech Summit, held at Lagos Continental Hotel, Victoria Island, Lagos on Thursday 15th November 2024

“NITDA worked with CBN to come up with a cashless policy, which gave birth to the fintech industry we are talking about today.”

“This led to the banks to start upgrading their infrastructures, both hard and software, and the FinTech identified gaps and started coming up with solutions that can bridge the gaps left by the banks,” he added.

The DG however stated that the agency is working with the Federal Inland Revenue Service and some other stakeholders to develop guidelines for electronic invoicing which will create opportunities for the Fintech.

“As a regulator with a focus on facilitating financial inclusion, we need to strengthen unified regulations and policy-making, because if you make policies without having the implementers in the room, it will be difficult for them to implement, “ he averred.

He also elaborated on NITDA’s efforts to bridge the digital divide as an essential factor for financial inclusion, underscoring the launch of a National Digital Literacy Framework to integrate digital skills in formal education.

Highlighting the agency’s efforts at fostering digital literacy and cultivating talents, he disclosed that the agency has engaged in collaborations with the Ministry of Education in integrating digital literacy into curriculum and also, with the National Youth Service Corps (NYSC) in training over 17,000 Youth Corp members annually.

He added that the initiative is expected to provide basic digital literacy to millions, and aims to engage artisans, market women, senior citizens, and others from the informal sectors.

Inuwa further addressed Nigeria’s data sovereignty issues, particularly regarding reliance on foreign cloud services. He noted that building in-country cloud capabilities is vital for national security and for empowering local FinTechs.

“Without operational sovereignty, we cannot fully control or secure our digital assets,” he stated, mentioning ongoing partnerships with hyperscale providers and local data centres to create cloud infrastructure within Nigeria.

He explained that the agency is working with other stakeholders in developing the cybersecurity architecture to achieve financial inclusion while asserting that infrastructures will be created, the unconnected will be connected and promoting digital literacy to foster trust on digital platforms.

Revealing that NITDA has several interventions and initiatives aimed at supporting the underserved and unserved areas in the country by building their digital capacities and skills, he urged the fintech to leverage these opportunities by infusing their financial literacy into them which will consequently drive a deeper financial inclusion for all.

“Nigeria has the infrastructure and with the right collaborations and continued focus on inclusive policies, we can make significant strides in bridging both digital and financial divides,” Inuwa concluded.

Other panelists who shared their insights and expertise at the session with the DG were the MD & CEO, NIBSS, Mr Premier Oiwoh, CEO, Lagos Lotteries & Gaming Authority, Mr Bashir Are and the Chief Information Officer, FirstBank of Nigeria, Mr Adewale Salami.