Business

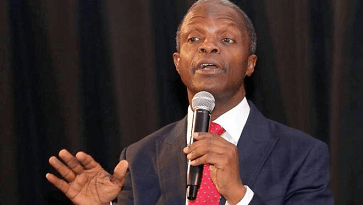

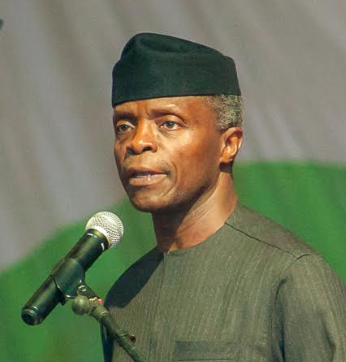

Nigeria Loses N197bn To Financial Services Fraud Annually —VP

By Lukman Amusa

The Vice President, Prof. Yemi Osinbajo says Nigeria loses about N197 billion as cost of financial services fraud annually. The Vice President made the observation at the stakeholders forum on financial fraud using telecoms platform organised by the Nigerian Communications Commission, NCC in collaboration with the Central Bank of Nigeria, CBN. Osinbajo, who was represented at the event by Barr. Bolaji Owoseye said the positive developments in the nation’s telecom sector attract new dangers because fraudsters have also infiltrated the system to compromise telecom platforms, thus putting all these positive outlooks from mobile money and financial services at risk, leading to loss of huge amount of money to fraudsters every day. Osinbajo He noted that fake mobile money have proliferated with cloning of banks with fraudsters to extract customers personal and financial information and other mischievous activities, insisting that we must continue to innovate to checkmate the cyber criminals. ‘‘The cost of financial services fraud to the country is a whooping 197bn annually. Fake mobile money have proliferated with cloning of banks with fraudsters to extract customers personal and financial information and other mischievous activities. ‘‘We can’t out of risk of fraudsters stop innovation. We must continue to innovate. There are elderly people who do not have ATM cards. They cannot associate with the risks associated with ATM cards. We must build confidence in the market to be able to bring in people who want to be within the platform. ‘‘One of the issues to resolve is who should have responsibility when fraud is committed. Sometimes you have four players: customers, bank, telecom, mobile service provider and nobody wants to take responsibility. Historical, innovations have always brought progress and development to mankind but in the wake has always come the dark side. ‘‘The anticipation and unanticipated consequences of any invention is always available for evil minded to exploit to the detriment of the society. Nigeria has like otherwise has inevitable embrace the digital world through the use of telecommunications. ‘‘However, the tread off for greater efficiency and versatility in this new world is the increased negative application of innovation for criminal disposition. Without telecommunication, the originator of fake news has no capacity to spread falsehood so rapidly to such a wide spread audience without being quickly nipped in the bud. ‘‘ But in today’s world, fake news excuses the world to great danger. Each sector of the economy and society is exposed in different way to mouse of technology or any innovation.’’ On why we must retail mobile payment platforms, Osinbajo said, ‘‘They provide opportunity for personal and business anywhere. They remain an economical means of achieving financial conclusion. They are critical to bring ginger within the social safety net the most vulnerable members of the society. ‘‘All the vendors in the Home Grown School feeding programs are encouraged to register through digital platforms. The Conditional Cash Transfer, though it is done in the rural areas, is done in cash but once a social register is done, effort is being made for all beneficiaries to get their stipends via mobile platform. ‘‘We must never out of fear refuse to innovate and be ahead of the fraudsters in the market. Right now there is no law that regulates Digital Currency in Nigeria. Nigeria has no law but there are people that use crypto currency. They are not waiting for law. But yet, there will be problems and those problems have to be solved. We cannot refuse to create platforms to check fraudsters.’’ Continuing, the Vice President said, ‘‘The issue of today, the vulnerability of the financial sector to negative use of the technology is timely because no one can dispute the relevance of telecom to improve financial services. Indeed, the use of telecom services have helped to reduce banks’ operating cost and customers’ satisfaction. Banks have obviously expanded their operational bases using these platform. ‘‘This proliferation of alternative banking channels through which banking transactions have performed. In this regard, the Nigerian banking industry has simply aligned itself with the global trend. However, it is this financial service delivery and opportunity for inclusion that is now threatened by fraud. Today, we are grabbing with new methods of fraud, such as Some card swaps, customer identity theft, bank or customer base hark, BVN snatching and compromise of customer systems etc. Earlier in his welcome address, the Executive Vice Chairman of NCC, Prof. Umar Danbatta said NCC has been collaborating with other agencies of government to not only achieve financial inclusion in the country but checkmate financial fraud courtesy of its 8-Point Agenda. According to Danbatta, the idea is to be able to do those things that commission is mandated to do by government courtesy of the Act establishing the NCC. ‘‘We realised early enough that it will be impossible to accomplish the 25 functions assigned to NCC without close collaboration with other agencies of government and the federal government has given a directive to the effect that the agencies must collaborate to be able to achieve their mandates. ‘‘ We are collaborating very well in the area of mobile money and financial inclusion to the extent that the CBN is poised at giving license to telecomm operators to provide some kind of special service vehicle to operate in the financial sector with a view to driving mobile money penetration, which stands at about only 1%, which is too low, compared to penetrations in countries like Kenya 60%, Ghana 50%. ‘‘The reason for these high penetration these African countries is because mobile money service in those country are telecom driven, while in Nigeria it is bank driven. The CBN has allowed the telecoms companies in Nigeria to go in and augment the efforts being made by banks in order to drive mobile money service as well as ensure more inclusion. The target is that 80% of Nigerian should be included in the mobile money service, leaving only 20% which we hope in due course will be included.’’ ‘‘Another important area of collaboration now is how to check fraud in financial industry. fraud that are being perpetrated by leveraging telecom infrastructure and the NCC is mandated to drive the deployment. This is happening at a time when the level of financial fraud has reached N12.5billion. so something needs to be done urgently to secure the confidence of Nigerians in the financial system as well as the telecom system within the country. ‘‘Subscriber loose 12.5bn to service providers. If the deductions are illegal, they know what to do to bring it to a stop. There is s a complaint number, 622, they can loge their complaint through this number to see redress. They can also lodge their numbers, nature of their complaints and we have seen instances where complaints were resolved quickly. ‘‘ We insist that where unfair deductions were made, such deductions should be returned to the subscribers. NCC will not rest on its oars until all illegal deductions are paid back to the subscribers as well as ensuring that subscribers have confidence that when they are illegally deducted , they will be rest assured that these deductions will logically pursued until they are returned to them.’’ For the NCC boss, another area of collaboration is when the Commission intervened jointly with CBN to stave off the take over of 9Mobile. This he said has been done successfully as they succeeded in protecting three to four thousand Nigerian jobs in pay roll of 9Mbile and also ensuring services to close to 18 million Nigerian are not disrupted. ‘‘We have succeeded in ensuring stability not only in the telecom sector but as well as in the financial sector. And we have succeeded to improving the image of this country to the investors who may which to come in to invest.’’ On his part, Deputy Director, Payment Systems at CBN, Musa Jimoh, said this particular stakeholders forum has afforded the CBN the opportunity to present some of the achievement it made within the payment system in direct partnership with NCC to resolve some of the digital communication issues we have. ‘‘NCC has actually tried in terms of providing effective platforms for financial services to thrive in Nigeria but there are still areas that we need to strengthened, which is why the stakeholders have come here to discus. ‘‘ One of the issues to be discussed is Sim Swap and how we can tame the incidences that are being committed as a result of Sim Card Swap. All tricks and methods had been applied but the fraudsters are still beating us down. We will be able to come up with resolution that will help us tame the fraud.’’