News

NIMASA, MWUN DIALOGUE ON FATE OF DISENGAGED NNSL SEAFARERS

AJAGBE ADEYEMI TESLIM

SPONSORED BY: H&H

The Nigerian Maritime Administration and Safety Agency, NIMASA, and the Maritime Workers Union of Nigeria, MWUN have begun discussions on how to resolve the lingering issue of terminal benefits of Seafarers whose appointments were terminated due to the liquidation of the defunct Nigerian National Shipping Line, NNSL.

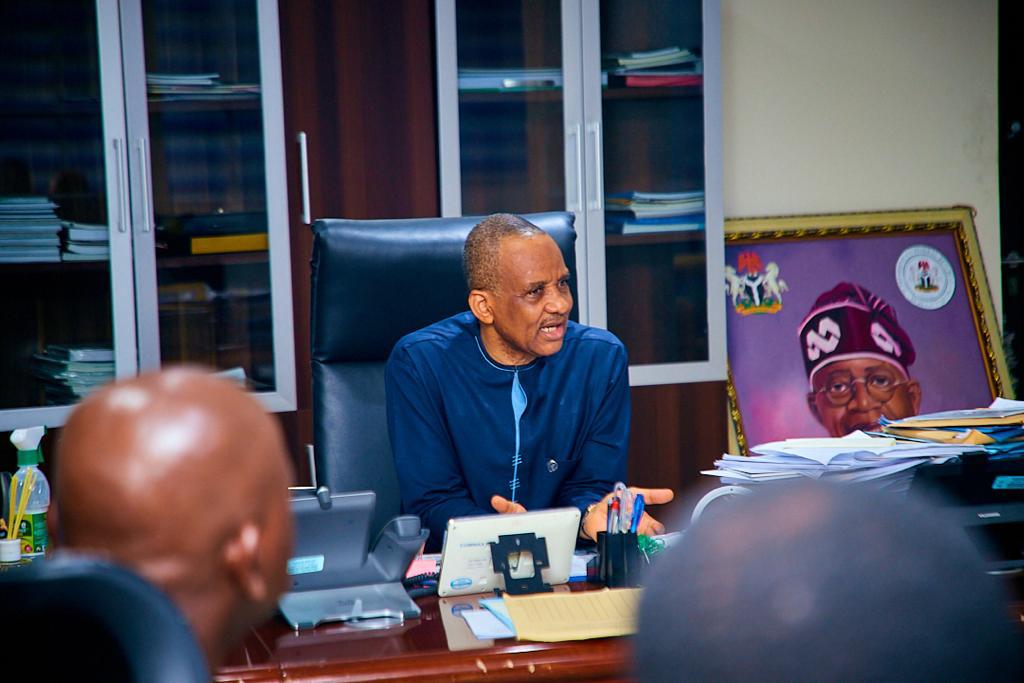

The Director General of NIMASA, Dr Bashir JamohOFR, and the Vice President of the Nigerian Labour Congress who is also the President General of the Maritime Workers Union of Nigeria, Comrade Adewale Adeyanju, jointly announced an agreement for physical verification of the affected seafarers/next of kin as the case may apply; the nature of appointment of all affected seafarers, and the exact amount due each beneficiary.

The NIMASA DG also assured the Union that theirposition will be communicated to the Ministry of Marine and Blue Economy, to ensure Government takes all necessary actions to bring to a conclusion, theissue of NNSL.

“The issue of industrial harmony in the maritime sector is of uttermost interest to our administration at NIMASA. We have been at this for a while. NIMASA had offered 100 million naira as settlement, which the Union declined. We have also discovered that some of those demanding settlement did not even have any employment letter. We will follow the lead from our supervising Ministry and ensure the physical verification exercise is brought to a logical conclusion. Our Honorable Minister will be duly updated by the Agency. I look forward to closing this issue in months to come”, the DG said.

On his part, the President General, Maritime Workers’ Union of Nigeria (MWUN) Comrade Adeyanju restated the commitment of the Union to peaceful resolution of disputes; to ensure the rights and privileges of workers are well protected, without disrupting productivity in the Maritime Sector. He commended the Jamoh led Management at NIMASA,urging others to follow suit.

“I will like to commend NIMASA under Dr Jamoh, for the unflinching commitment to industrial harmony. He is always a phone call away to resolve any issue. Yes, NIMASA offered 100 million naira to offset the terminal benefits. However, if others like Nigerian Ports Authority, Nigerian Shippers Council and the rest also add funds, there will be enough to go round the expected beneficiaries. As we did for dockworkers when a flat rate of two hundred thousand was paidduring port concession; that is what we want, putting into consideration the realities on ground now.