Business

BUA Industries secures US$200 million Facility from Afrexim Bank to support Expansion Plans

BUA Industries secures US$200 million Facility from Afrexim Bank to support Expansion Plans

AJAGBE ADEYEMI TESLIM

SPONSORED BY: H&H

African Export-Import Bank (Afreximbank) has approved a US$200 million Corporate Finance Facility in favour of BUA Industries Limited to support its expansion plans.

BUA is a Nigerian conglomerate with diversified business interest spanning across, sugar and cement manufacturing, flour milling, oil milling, port logistics, real estate development, oil and gas, and shipping. The first tranche of $150 million was disbursed on October 16, 2024.

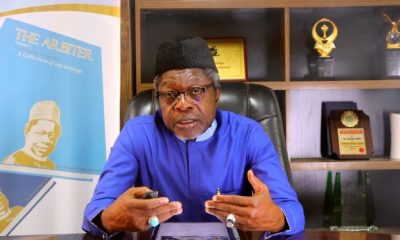

Speaking on the transaction, Abdul Samad Rabiu, CFR, CON, Chairman of BUA, said that the $200 million corporate finance facility from Afrexim Bank, marks a crucial step in BUA’s commitment to industrialising Nigeria’s manufacturing, infrastructure and energy sector for local use and export. “With Afreximbank’s support, BUA can increase investments to strengthen industrial capacity and meet regional demand. Our goal is sustainable growth that boosts Nigeria’s self-sufficiency and Africa’s global trade presence, creating jobs and building economic resilience,” he said

Commenting on the transaction, Mrs. Kanayo Awani, Executive Vice President, Intra Africa Trade and Export Development, Afreximbank, said that the facility would provide critical financial support to a leading Nigerian conglomerate as it pursues its expansion plans, thereby boosting its industrial base and Nigeria’s export manufacturing capacity.

“We are delighted at this partnership, which promises to deliver significant impact through job creation, import substitution, and export diversification – thereby boosting Nigeria’s Gross Domestic Product (GDP).”

Over the past decade, BUA has solidified its reputation as one of Africa’s fastest-growing and reputable companies with business interests spanning critical sectors of the African economy. With its headquarters in Lagos, Nigeria, BUA has expanded its business operations in the past few years to take advantage of the African Continental Free Trade Area through exports.

.About BUA Group

Established in 1988, BUA Group is one of Africa’s largest diversified groups operating out of Nigeria with its key interests in foods, mining, manufacturing and infrastructure. Its vision is to unlock opportunities that will drive sustainable development whilst providing value to all stakeholders and the African continent. The Group’s investments span the following sectors: Cement, Sugar, Flour, Pasta, Steel, Rice, Real Estate, Energy, Logistics, Ports and Terminals with a core focus on building local manufacturing capacity to generate employment, and provide high quality products and develop the African continent. www.buagroup.com