CIBN President, Olugbemi Says eNaira ‘II Deepen Financial Inclusion

AJAGBE ADEYEMI TESLIM

SPONSORED BY: H&H

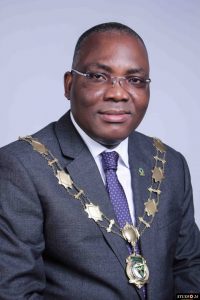

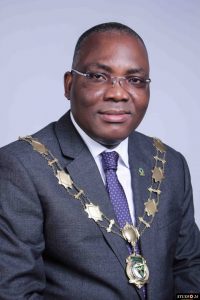

The President of the Chartered Institute of Bankers of Nigeria (CIBN), Dr. Bayo Olugbemi has commended the introduction of the country’s first digital currency, eNaira, saying it

Odugbemi

was part of measures to deepen financial inclusion and integrate millions of unbanked Nigerians into the banking system.

Dr. Olugbemi, who spoke at the 56th Annual Bankers Dinner of the institute, noted that while the modality for the operation of the Central Bank Digital Currency (CBDC) is being finetuned, the launch of the electronic currency was a step in the right direction.

He commended CBN governor, Godwin Emefiele for innovative introduction of eNaira, saying” I have no doubt in my mind that it is a welcome development and a step in the right direction.

“Equally worthy of note is the improvement, though slight, being witnessed in the exchange rate of the Naira. I wish to call for its sustenance. We are certainly working in interesting times with global growth rate at its lowest and traditional norms being challenged on a daily basis.”

Olugbemi, who was attending his last CIBN dinner as the president of the institute as he would be handing over the mantle of leadership of the institute by May 2022, noted that his tenure builds “on the solid foundation laid by our predecessors, rooted in the tradition of constantly leaning forward into the future.

He thanks members of the institute for their support in the implementation of the A-TEAM Agenda of his administration. “I want to assure you that the Institute will continue to devote its resources to the development of competencies whilst strengthening observance of ethics and professionalism in the banking industry.

He said traditionally, the Annual Bankers Dinner is the “CBN Governor’s Day” because it affords stakeholders’ the rare privilege of interacting and listening to Mr. Governor as he examines critical issues and fundamentals which has affected the banking industry within the year.

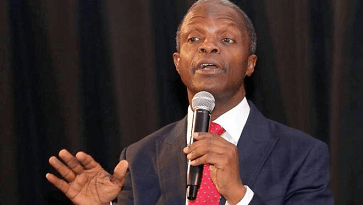

In his keynote address, the Governor of the Central Bank of Nigeria (CBN), Mr. Godwin Emefiele who was the Special Guest of Honour stated that “In less than 4 weeks since its launch, almost 600,000 downloads of the e-Naira application have taken place. “Efforts are ongoing to encourage faster adoption of the e-Naira by Nigerians who do not have smartphones.

“The support of the financial industry will be critical in the ongoing deployment of the e-Naira and efforts are ongoing to encourage continued partnership between the CBN and stakeholders in the financial industry,’’ he said.

The CBN governor noted that building a robust payment system that would provide cheap, efficient, and faster means of conducting payments for most Nigerians have always been the focus of the apex bank.

Emefiele said that total transaction volumes using digital channels more than doubled between 2018 and 2020, as volumes rose from 1.3 billion to over 3.3 billion financial transactions in 2020.

He said that Digital payment channels also helped to support continued conduct of business activities during the lockdown.

He said the banking sector robust payment system has continued to evolve towards meeting the needs of households and businesses in Nigeria, reflective of the confidence in our payment system, indicating that between 2015 and September 2021, about US$900 million has been invested in firms run by Nigerian founders.

Mr. Emefiele also stated that the policies created to ensure stability in the exchange rate saw more transactions flowing through the official Investors & Exporters FX window (I&E FX Window) which raised its average daily Fx turnover to $250 million from $40 million in April 2020.

Gov. Babajide Sanwo-Olu in his remarks stated that, bankers “must ensure that the fundamental economic indicators, both micro and macro, of our economy, are a true reflection of what the realities are in the various sectors of the economy.”

Sanwo-Olu said, “We will certainly need to review the traditional economic and monetary models in the face of changing realities and the desire to achieve maximum impact and outcome vis a vis our policy objectives.

“But even as we do this, we must never lose sight of our primary mandates as institutions and organizations. He said the funds banks deploy must create jobs, boost exports, build capacity, and guarantee prosperity for significant numbers of our population.

The Niger State governor, Abubakar Sani Bello and Chairman North Central Governors Forum using the forum to donate a facility in Minna, the state capital to the Chartered Institute of Bankers in Nigeria (CIBN) to serve as the North Central Regional Office in other to strengthen the relationship between the Banking industry in Nigeria and the North Central part of the country.

Highlights of the event was the presentation of the various awards to Next Generation Class of 2021 which recognizes a class of young bankers who are excelling and have contributed exceptionally to the industry and economy with your institution; X-factor Award which recognizes a leading female banker breaking the glass ceiling and inspiring a more gender inclusive Industry was awarded to OlaronkeKing; Affiliated of the year Award which recognizes an industry affiliate/agent whose performance has enhanced the Industry’s goal of financial inclusion was Award to Paystack Payments Limited ; Next Generation Customer Award which recognizes a business in an identified strategic sector that has been catalyzed by the industry’s support was awardes to Faith Agro and the Covid-19 Response Banker of The Year Award which recognizes employees that innovatively stepped up beyond the call of duty in the fight against Covid-19, to ensure business continuity despite the scourge of the pandemic was jointly awarded to Ameachi Okobi of Access Bank and Dr. Segun Oghuan of FBN Ltd

The Group Managing Director/CEO of Wema Bank Plc, Mr. Ademola Adebise served as the Chairman of the Organising Committee of the event.

The Annual Bankers Dinner had in physical attendance Commissioner’s of Finance and Budget and planning of various states, Chairmen of Banks, British Deputy High Commissioner to Nigeria, President, IoD; Deputy Governors of the Central Bank of Nigeria; President of Professional Bodies; Director-General, SEC and his Commissioners; MD/CEOs of banks; Past Presidents and Registrars of the Institute, Diplomats, Captains of Industries, Business leaders, and financial analysts.

News5 years ago

News5 years ago

News5 years ago

News5 years ago

News5 years ago

News5 years ago

News5 years ago

News5 years ago

Politics5 years ago

Politics5 years ago

Politics5 years ago

Politics5 years ago

Politics5 years ago

Politics5 years ago